40+ How to calculate your borrowing capacity

Your borrowing capacity is the maximum amount lenders will loan to you. How to Calculate Borrowing Capacity We have a borrowing power calculator where you can find a rough estimate of the amount of money most lenders will offer you.

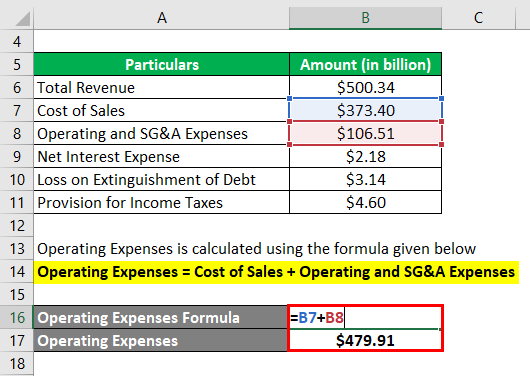

Profit Margin L Most Important Metric For Financial Analysis

No credit check is involved nor is it a guarantee of the approved financing which you may receive by National Bank.

. Send an email to the author. Ad Find Out How Much You Can Afford to Borrow. Its worth looking at consolidating your debts and rolling them over to a.

How To Calculate Your Mortgage Borrowing Capacity. Standard borrowing capacity is between 30 and 40 of income which means that debt should never exceed 13 of. While there is a standard formula lenders follow lenders may assess your income or expenses differently.

There are a number of factors that can affect your borrowing capacity. Read on to find out how to determine it. Our Maximum Borrowing Capacity Calculator is mirrored to Mortgage Insurers parameters making it one of the most accurate estimators in the market today.

Find a great professional for your needs - its free and easy. Ad Need a Business Loan. And not the gross income but the after-tax income.

Lenders generally follow a basic formula to calculate your borrowing capacity. View your borrowing capacity and estimated home loan repayments. The lender uses your age income expenses existing debts job status dependents deposit size and other factors to consider your risk level.

Essentially your borrowing capacityis determined by figuring out the difference between your net income what you get paid after taxes minus your total monthly expenses. 2 days agoUnder the new initiative millions of federal student loan borrowers will be eligible for 10000 in loan forgiveness or up to 20000 if they received Pell Grants. Your borrowing capacity is calculated by adding your gross income deposit size and credit score.

Get Offers From Top 7 Online Lenders. Typically the greater the risk ie less likely to pay back your mortgage each monthly payment the lower your borrowing power. Calculate Your Estimated Borrowing Capacity Using Home Equity HELOC Depending upon the market value of your home outstanding mortgage balance credit history and other factors you may qualify for a home equity loan.

Your expenses and other debts count against you. The borrowing capacity formula Lenders generally follow a basic formula to calculate your borrowing capacity. Gross income - tax - living expenses - existing commitments - new commitments - buffer monthly surplus While lenders all adopt this general framework there are differences in how they weigh and assess each dataset outlined below.

So on that same loan amount you would need to show a sufficient income to debt ratio to afford 11250 per annum or 93750 per month. Home loan providers analyze income to determine how much a person can afford to pay for a mortgage. OpenCorps Michael Beresford outlines how to calculate your borrowing capacity.

This borrowing capacity calculator will allow you to estimate the amount that you likely will be able to borrow from a lending institute. When estimating how much you can afford to pay we recommend being slightly conservative with the amount. The lender wants to know how much you have surplus each month that could go towards a home loan.

A mortgage pre-approval certifies your borrowing capacity based on several criteria including your credit rating. Its calculated based on your basic financial information such as your income and current debt. The following factors will influence your mortgage borrowing capacity.

Under tighter serviceability rules your bank may assess your borrowing power at principal and interest PI at 750 or even higher. The exact amount will depend on the lenders borrowing criteria and your individual circumstances including how much equity you have in your property. Thinking of buying a new property and need to know your mortgage borrowing capacity.

Back to the list. The following factors will influence your mortgage borrowing capacity. Lenders generally follow a basic formula to calculate your borrowing capacity.

This calculator also shows how much you could borrow with a slightly larger payment per period. To improve your borrowing capacity decrease your risk level. Try Our Customized Mortgage Calculator Today.

30360 is calculated by taking the annual interest rate proposed in the. The Maximum Borrowing Capacity Calculator provides you with an indication of how much Lenders are prepared to Lend according to your Income and Liabilities. Estimate how much you can borrow for your home loan using our borrowing power calculator.

It confirms the amount that National Bank agrees to lend. International Customers can call 675 305 7842. Compare Mortgage Rates Estimated Monthly Payments from Multiple Lenders.

Monthly payments on a Home Equity Loan HELOC are variable as they fluctuate with interest rate changes. Borrowing capacity is the maximum amount of money you can borrow from a loan provider. Equity is the difference between your propertys market value and the amount of money you still have.

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Your borrowing capacity is calculated by adding your gross income deposit size and credit score. The first and most obvious factor is your income.

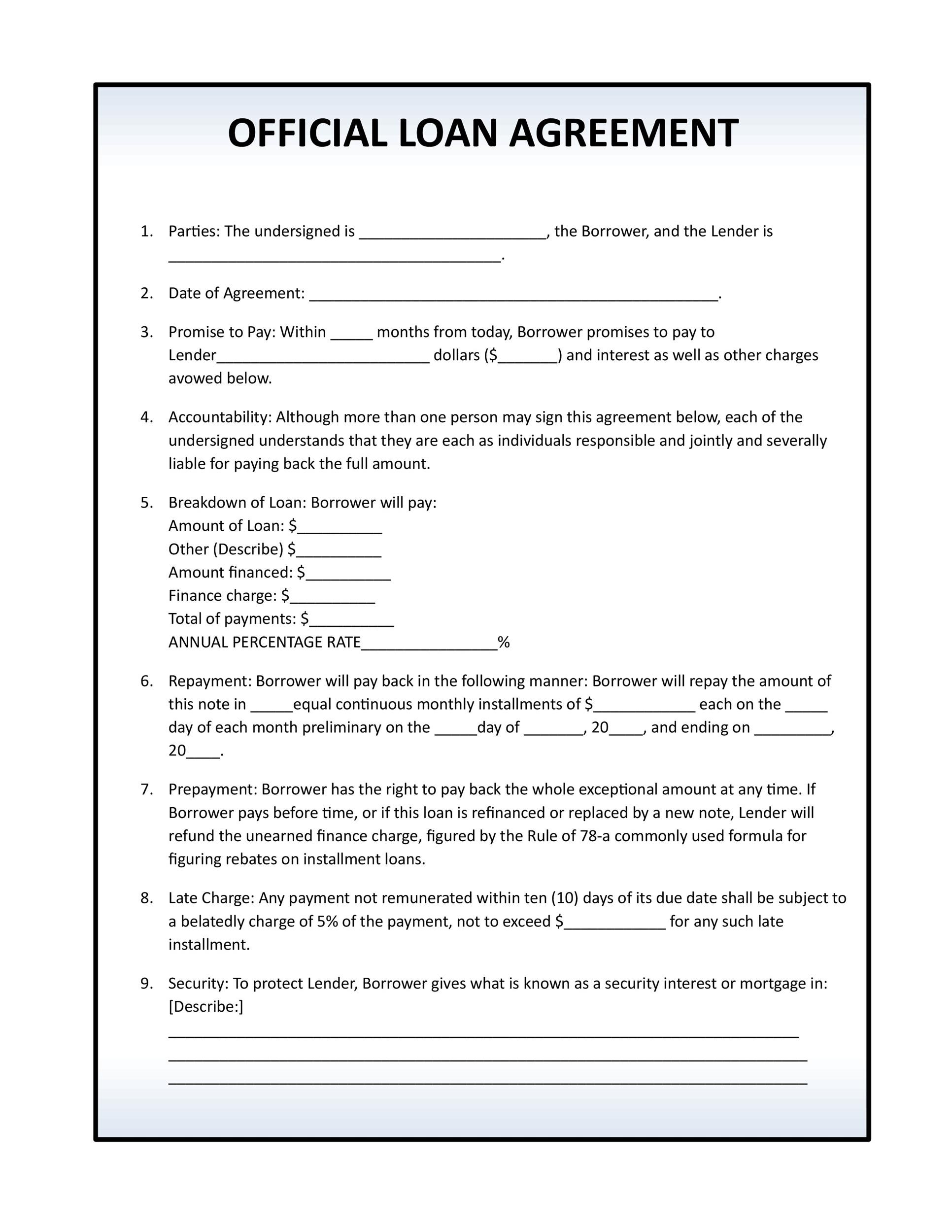

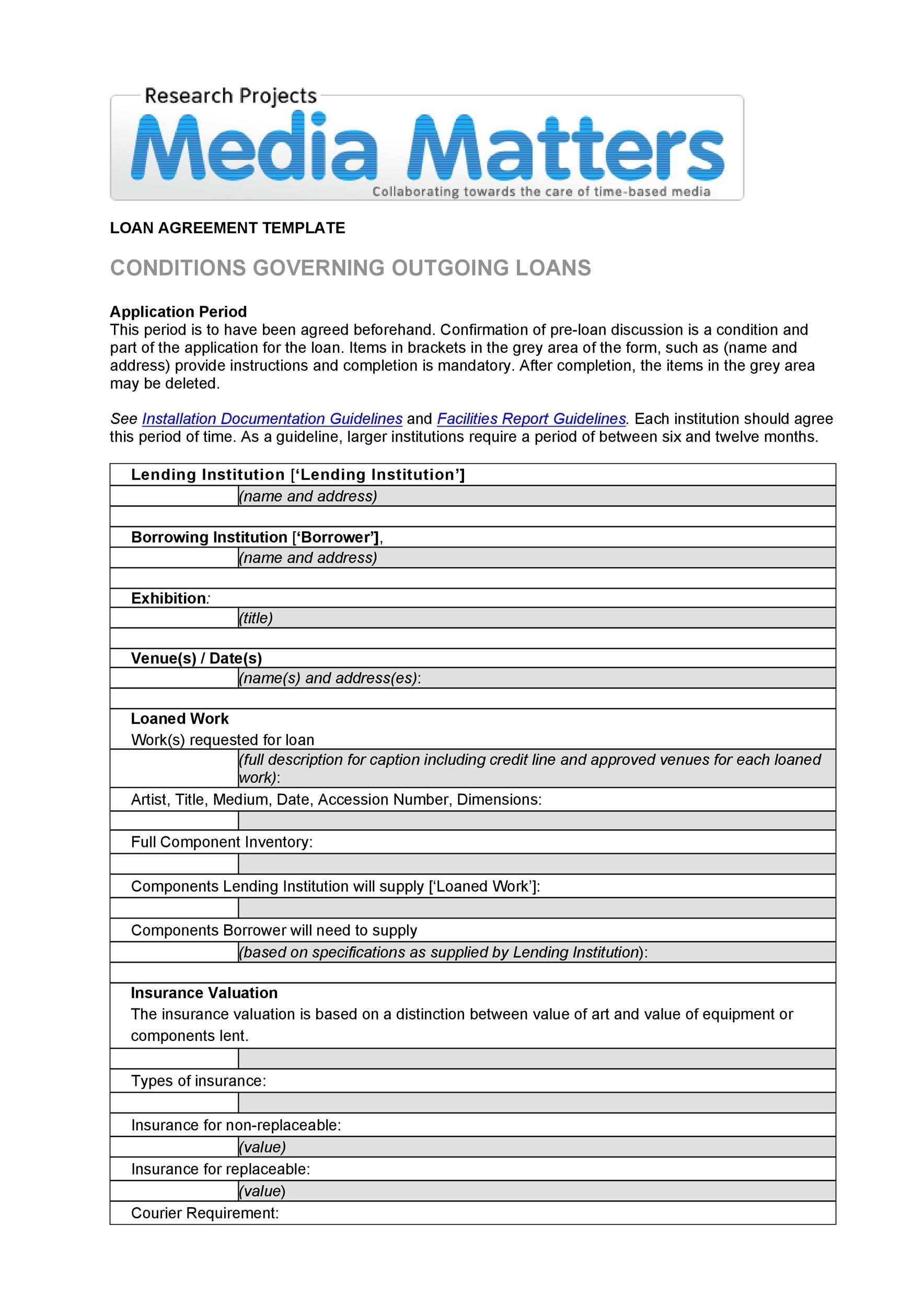

40 Free Loan Agreement Templates Word Pdf ᐅ Templatelab

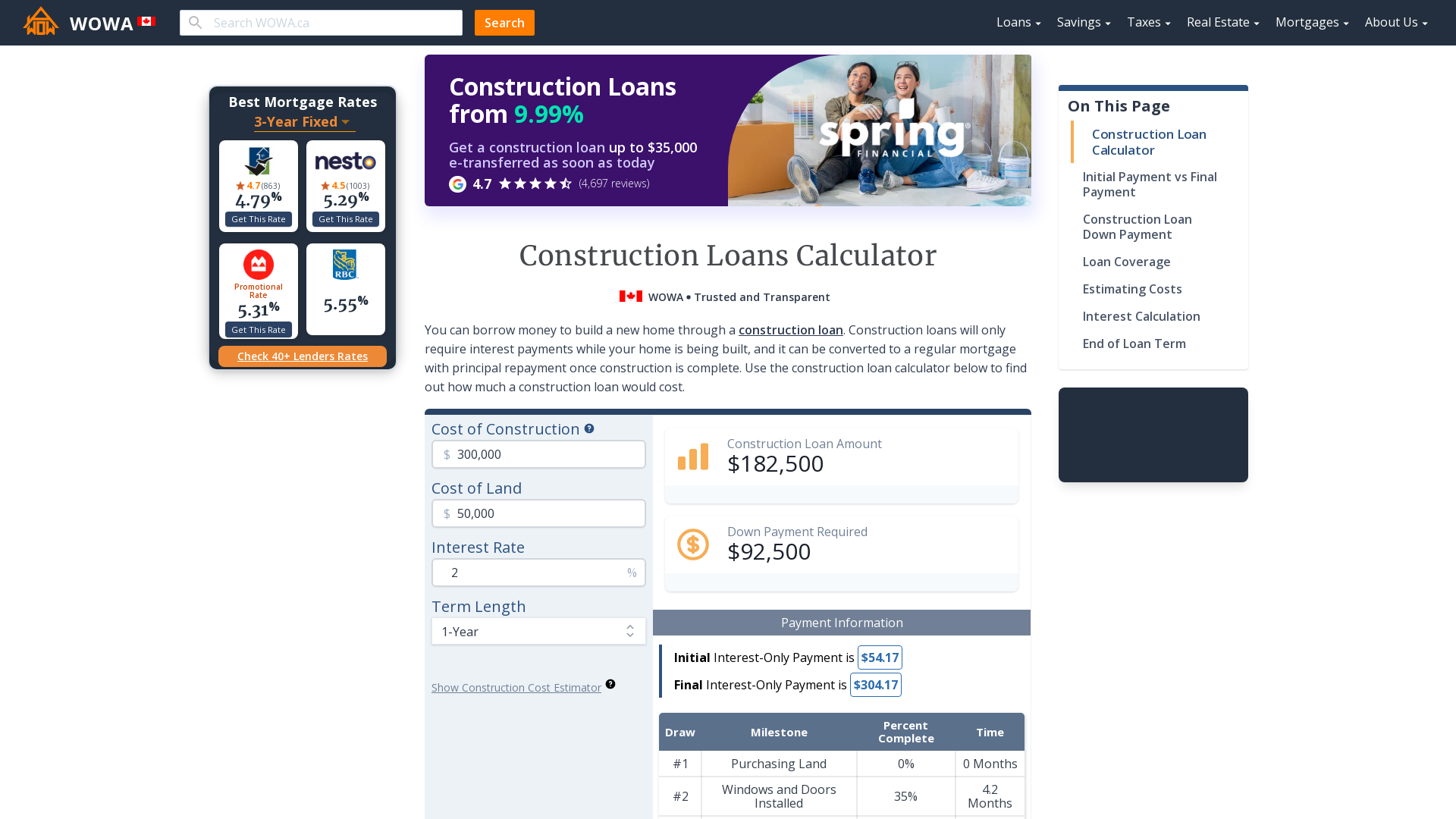

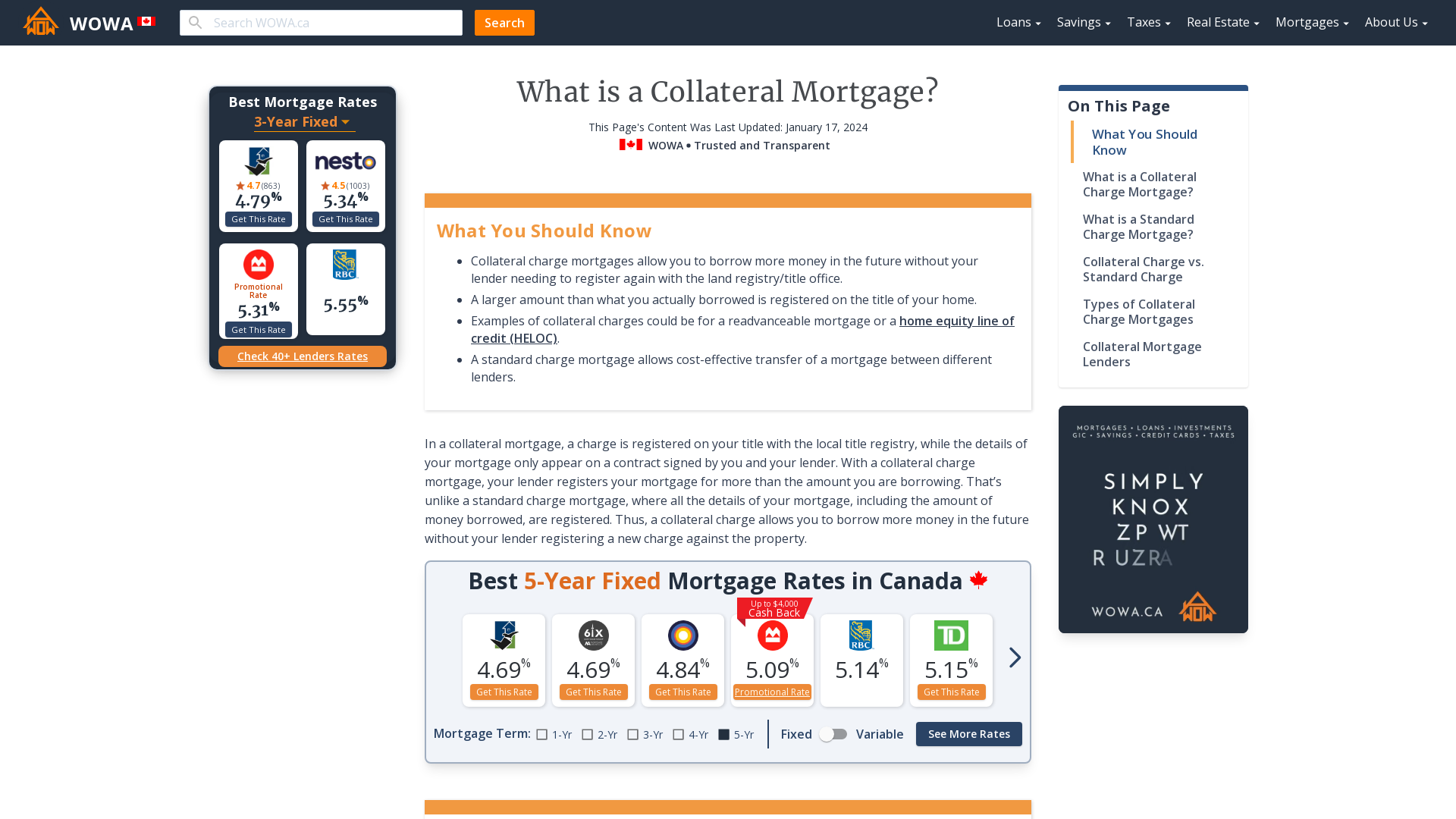

Construction Loan Calculator For Canadian Builders Wowa Ca

Download Personal Loan Agreement Template Pdf Rtf Word Doc Wikidownload Personal Loans Contract Template Loan Application

How To Get A Mortgage With Bad Credit Comparewise

Heloc Calculator Calculate Available Home Equity Wowa Ca

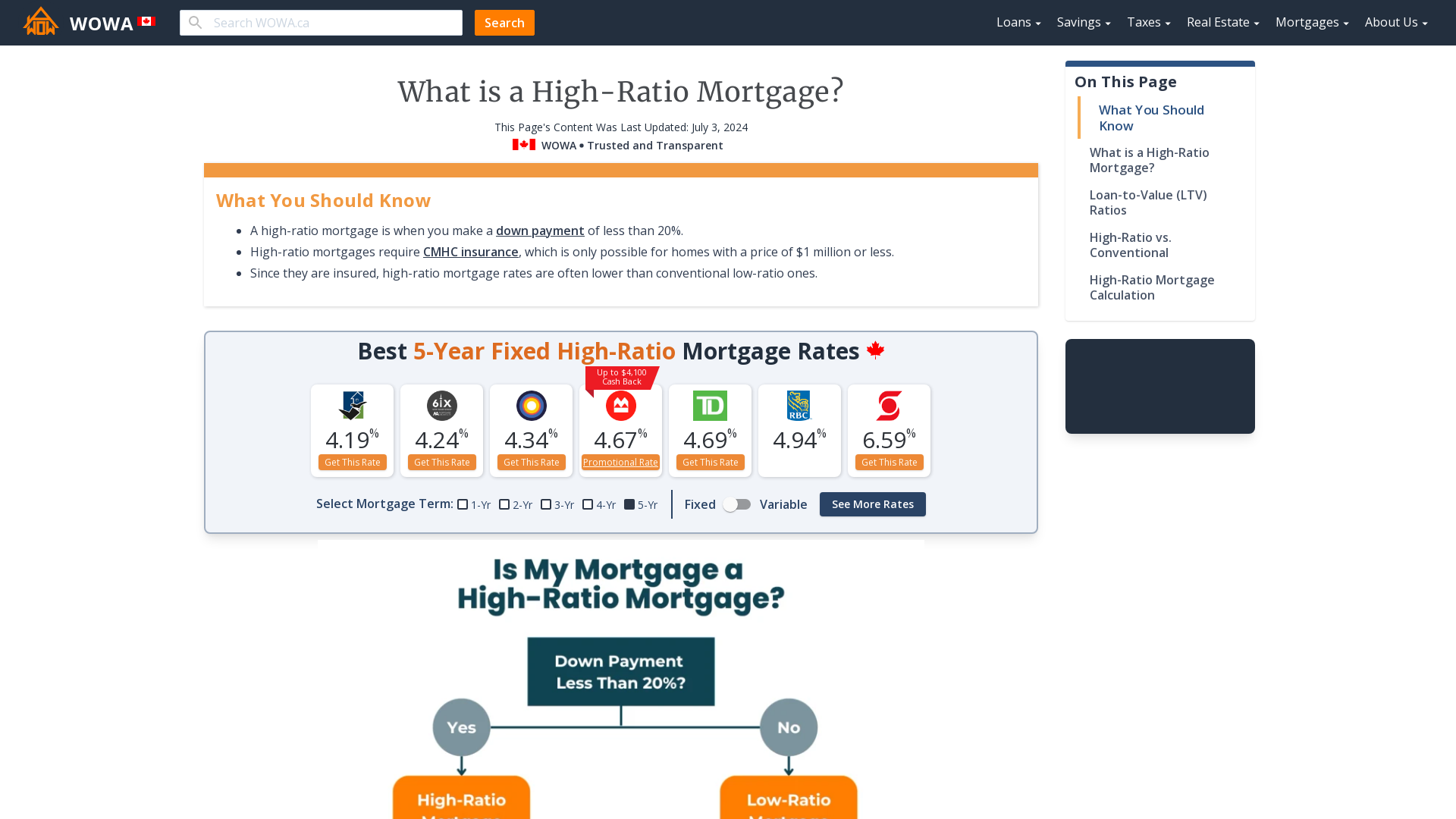

What Is A High Ratio Mortgage Pros Cons Wowa Ca

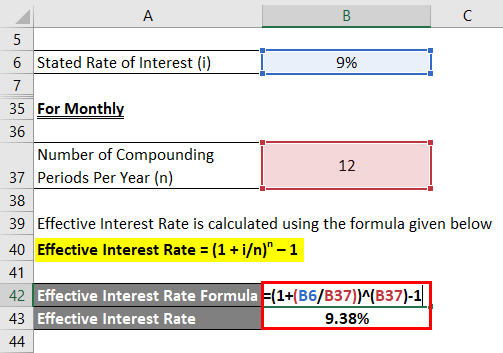

Effective Interest Rate Formula Calculator With Excel Template

Instant Crypto Credit Lines Borrow From 0 Apr Nexo

Mortgage Affordability Calculator Based On New Cmhc 2022 Rules Wowa Ca

40 Free Loan Agreement Templates Word Pdf ᐅ Templatelab

Borrowing Power Calculator It S Simple Finance

What Are Some Of Ideas You Can Use To Pay Off Your Mortgage Quicker Quora

How To Use A Mortgage Calculator Comparewise

Jsqnt Gqgxdjfm

Easyhome Review 2022 Comparewise

Mortgage Refinance Guide Procedure Costs Calculator Wowa Ca

Instant Crypto Credit Lines Borrow From 0 Apr Nexo